Do you want to fix and flip your house but don’t have the funds to do it?

House flipping is a way of investing in real estate where you purchase inexpensive properties that usually need work, repair them, and then sell them at a profit.

House flipping is financially risky, especially for beginners. Typically, it costs less to buy a house than to fix and flip one. But if done properly, house flipping can bring great returns.

PRO TIP: Now is the time to get into real estate investing, and experienced real estate investors use Invelo to find prospects, manage leads, track deals and run marketing campaigns.

Because of the associated risks, lenders want to work with an investor who has successfully flipped at least once. They usually don’t want to work with inexperienced investors. Even if they do, they tend to charge higher interest and fees.

What is a fix and flip loan?

Fix and flip loans are short-term loans (usually for 6-18 months) used by real estate investors to flip a house. You can take a loan that will cover both the home mortgage and the renovation costs. Or, you may use the loan just for remodeling the property.

Fix and flip loans usually have a fixed interest rate. You keep paying the monthly mortgage while you work on the house or wait for it to sell. After you’ve sold the house, you pay the remaining balance of the loan.

Now let’s look at the different types of fix and flip loans.

Hard money loan

Hard money loans have more difficult terms and are more expensive than traditional loans. The collateral for a hard money loan is the real estate property itself.

Sounds quite daunting, right? Then why would an investor want to take a hard money loan?

The terms for hard money loans are usually less than a year with interest rates of 12-18%. Plus, you can receive 2-5 points, where each point is valued at 1% of the loan amount.

For example, if you borrow $100,000 and the lender charges 5 points, you will have to pay 5% of $100,000, which is $5,000. Unlike a traditional mortgage, you may be exempted from paying points until the property sells.

Whereas banks provide conventional loans, hard money loans are provided by privately-owned lending companies that eliminate the bureaucratic red tape. The lenders aren’t bound by any guidelines on the real estate’s shape.

For instance, dilapidated houses don’t meet the guideline for conventional mortgages. On the other hand, hard money lenders decide to give loans by evaluating the investor’s reliability and the deal’s strength.

As long as the resale value is greater than the total purchase and renovation cost, they don’t usually bother much about the borrower’s creditworthiness and whether the down payment funds are borrowed. This is because if the investor defaults, the lender can foreclose to become the owner of the property and sell it at a profit.

The lending companies usually have good knowledge of the local market and a network of realtors and contractors, making them well-chosen strategic partners.

Now, hard money lenders select the amount borrowed based on the property’s after-repaired value (ARV).

For instance, if a house costs $100,000, whereas the ARV is $190,000, you can borrow as high as 70% of the ARV - $133,000. You’ll be left with $33,000 after buying the house.

If you strictly stick to the $33,000 budget, you will be able to pay all the associated costs without having to spend your money. These costs include the renovation expenses, lender fees, closing costs (if the seller doesn’t pay it), selling expenses, and carrying costs.

However, it might be hard to maintain the budget if you’re charged with significant points and a high-interest rate. Still, you can manage to score a profit by selling the house at the ARV.

Private lenders

Private lenders are individuals who have the substantial resources you need to invest in real estate. They function much like hard money lenders and are similarly lenient with qualifications. They may even charge better rates and offer better terms.

Private lenders may charge 8-12%, along with 0-2 points. They also take a first-person lien on the property like banks and hard money lenders.

The catch here is to distinguish the good lenders from con artists. Some may charge unexpected fees later on, while others may hide contract terms until they catch you in default and foreclose on the house.

Nonetheless, the trick is to act smartly and negotiate confidently. You can tap into your network of house flippers to know about good private lenders in the market, how much they charge, and what terms they offer.

Private lenders are usually more open to negotiations. Moreover, they may choose to be your business partner on a deal and take a certain profit percentage instead of charging interest.

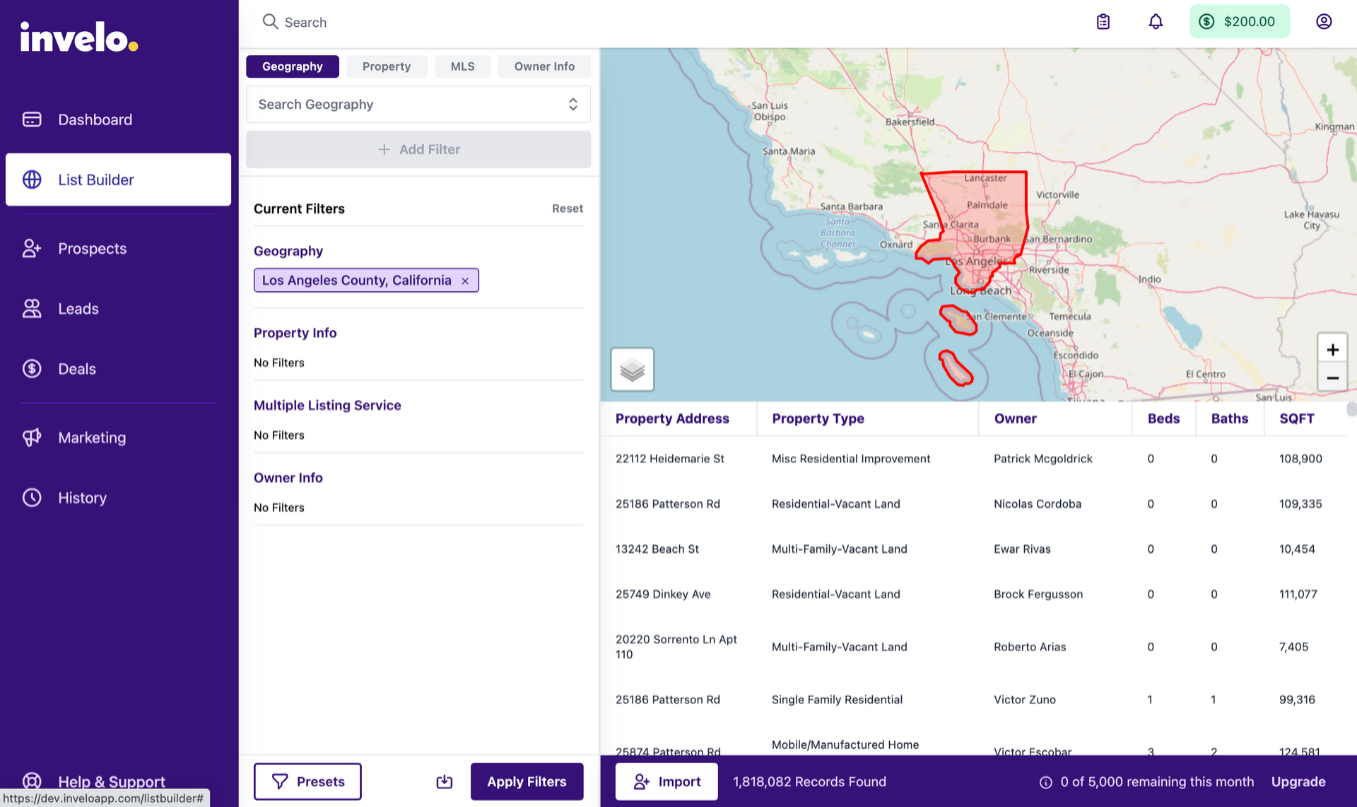

PRO TIP: Want to find properties to fix and flip? Use Invelo's list builder to search by 100+ filters and find the perfect property to invest in.

Home equity line of credit (HELOC) or Home equity loan (HEL)

Your home secures both home equity loans and home equity lines of credit. So you give your house up as collateral. Here, equity is the market value of your property minus your mortgage balance.

You need to have over 20% equity to qualify for a HEL or HELOC. Most banks will lend you 80-85% of the home’s market value, minus the remaining mortgage balance.

A HEL is a loan with a fixed term, granted based on the equity on your home. They are sometimes known as second mortgages. You can apply for a specific amount, and if it gets approved, you will receive cash in a lump sum upfront.

A HEL comes with a schedule of fixed payments for the loan term as well as a fixed interest rate. On the contrary, a HELOC is a revolving credit line where you can keep borrowing money as needed until the credit term ends.

It allows you to obtain cash against the credit line up to a predetermined limit, makes payment, and take cash out again. Because the borrowed amount is subject to change, the minimum payments can change too.

Suppose you have a 25% equity on a $150,000 house. This makes your remaining mortgage balance $112,500. If the lender lets you borrow 80% of the equity, you can get a HELOC or HEL for ($150,000*85% = $127,500 - $112500 = $15,000.

HELOC terms are divided into two parts. The first part is the draw period that lets you withdraw funds, where the withdrawal period may last 10 years. Then comes the subsequent repayment period that may be as long as 20 years. This makes HELOC a 30-year loan. The draw period still requires you to make payments, usually just interests.

Since you have to pay both your mortgage and the HEL/HELOC interests side by side, these forms of loan are quite risky, especially for new house flippers. Furthermore, you need to rely on banks that may lengthen closing delays and application processes. The interest rates are below that of hard money loans, though.

Cash-out refinance loans

A cash-out refinance loan is a new mortgage on your house for a higher amount than you currently owe. Here, you refinance a current property’s equity to fund your fix and flip and pay off the current mortgage. You can use any remaining amount to finance your investment as well.

The cash-out refinance loan won’t be cost-effective unless you have a 30-40% equity (more than a HELOC) in your house. You’ll also need to pay closing costs. Most banks tend to give an 80% cash-out of your property’s value.

The risks and complications associated with cash-out refinance loans are similar to those of other home equity options.

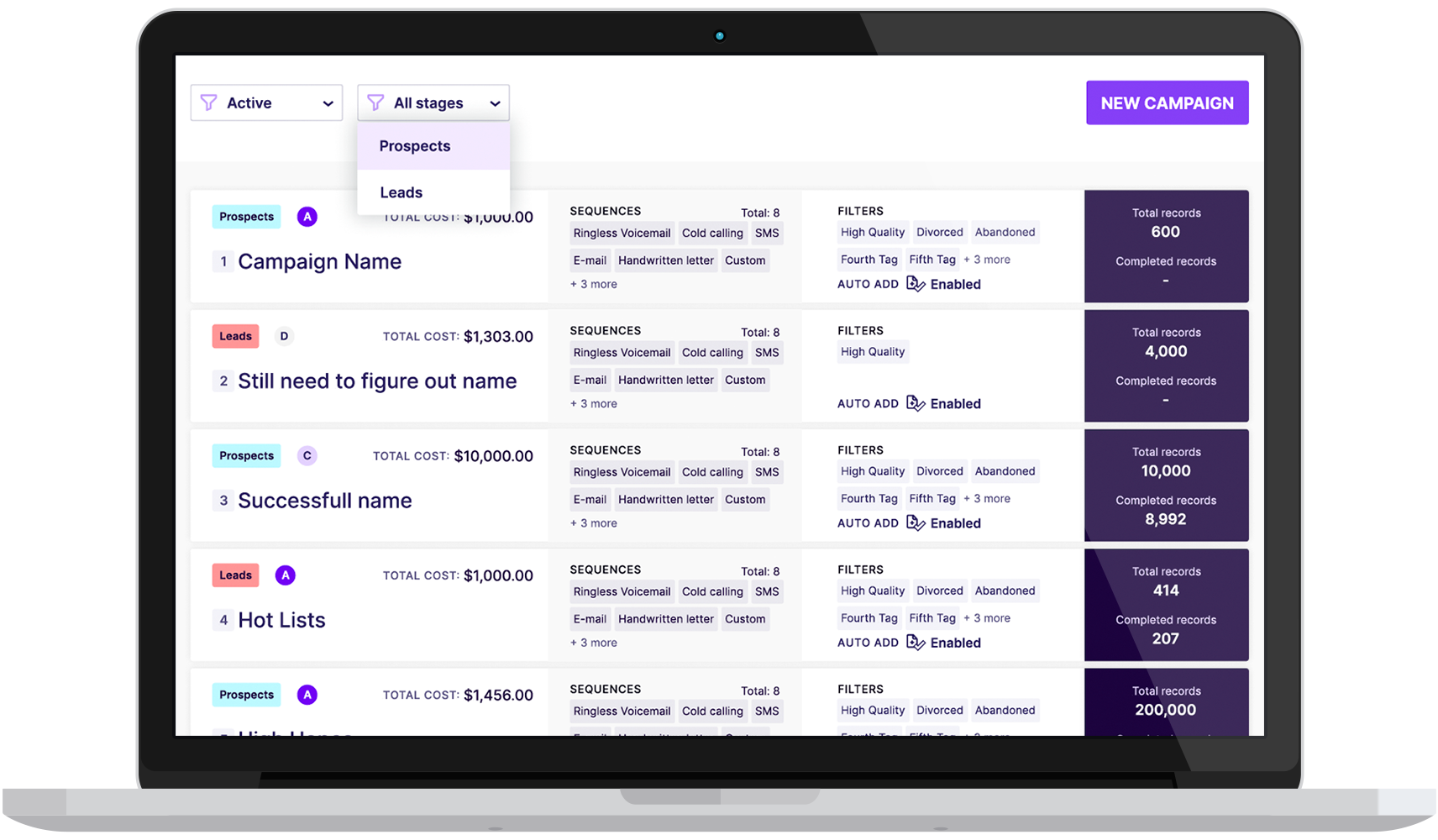

PRO TIP: Want to save time and market to hundreds of real estate investment prospects automatically? Use invelo's marketing and sequences to quickly build a campaign that automatically targets new prospects while you sleep.

Seller financing

In seller financing, you work with the seller to create a payment plan, a contract, and the payment amount with interest. You pay the seller directly according to the preset schedule.

Seller financing is riskier for the original owner. Hence, the loan term is usually shorter, and the interest rate is higher.

It can still be a great way to finance your house flipping if you can’t avail yourself of any other option.

Crowdfunding

As the name suggests, crowdfunding involves a group of individuals and/or institutions working together to finance a loan. For house flipping, crowdfunding takes place via a few special websites and companies that were set up specifically for this purpose. Each lender, also called an investor, provides a small percentage of a borrower’s loan and earns interest on that amount.

Some of these crowdfunding sites won’t close your loan unless investors fully find it, in which case closing could be very slow. Others will pre-fund your loan. Pre-funding occurs when the crowdfunding company closes your loan as soon as possible while waiting for investors to fund it.

Like other crowdfunding sites, people can invest different amounts of money from all over the country. Plus, they charge high-interest rates (some as high as 26%) like hard money lenders but provide much greater flexibility than conventional banks.

The flexibility, however, is not always guaranteed since the company is responsible for a big group of investors and thus, operates on predetermined terms.

Online mortgage or Permanent bank loan

You can get a regular mortgage online or from a conventional bank if you’re seeking to purchase a house to live in for 5 years or more. You’ll get a maximum of 30 years to make payments and even qualify for lower interest rates.

Remember that you’ll have to save a substantial amount of money to make a down payment and show a stable income. Also, your creditworthiness needs to fall between good to excellent to qualify for a mortgage.

Acquisition line of credit or Investment property line of credit

An acquisition line of credit specifically caters to real estate investments. It is similar to a HELOC, but it’s not based on your home’s equity.

You can gain approval for an acquisition line of credit only if you show good creditworthiness and a successful history of flipping or owning houses.

An investment property line of credit is also similar to a HELOC, where you can borrow against your property’s equity and put it up as collateral.

Here too, you need to show high creditworthiness and a record of successful real estate investments. Plus, you usually have to own the house for a minimum of 1 year to be eligible for an investment property line of credit.

Business line of credit

A business line of credit involves a revolving credit line, where you can borrow up to a preset amount but pay interest only on the amount you really use. You need to have a good track record of successful real estate deals to qualify.

Like a HOLEC, you can tap into the business line of credit again and again whenever you need funds. Most banks offer this line of credit.

Bridge loans

A bridge loan refers to a temporary loan that’s used to cover the time between when you want to purchase a property and when you can receive long-term financing.

You can use it to pay your down payment and then work to find another financing option, such as a regular mortgage, to pay the remaining amount. You can also opt for bridge loans to buy a new property before selling another one.

Bridge loans usually need to be secured by collateral. So, you can get a loan with a lower interest rate compared to some other fix and flip loan options. For most borrowers, bridge loans tend to be easier to qualify for.

So which fix and flip loan is right for you?

A variety of fix and flip loans are available to help you invest in real estate. Before selecting any or a combination of the options above, make sure you evaluate offers from several lenders and even account for your creditworthiness and experience. It’s also useful to tap into your own network to get reliable recommendations to make an informed decision.