Real estate investing can be an easy way to make passive income. One of the simplest methods to get started in real estate investing is to wholesale properties.

Real estate wholesaling is great for those who wish to enter into business but lack the financial means. This process also helps you avoid risks and tying up funds for the duration of the rehab.

PRO TIP: Get started with real estate investing right now with Invelo - Find Prospects, Market to Leads, Track Deals and Make money. Signup for free and see how easy it is to make money buying and selling homes.

One of the best things about becoming a wholesaler is that you don't need any courses, exams, or real estate licenses. Wholesaling could be a good fit for you if you’re patient and have good people skills.

While wholesale real estate provides an easy entry into the industry, your success will be contingent on a few factors. To begin, you must have a basic understanding of wholesale real estate and all that it entails so let's go through that first.

What is Real Estate Wholesaling?

Real estate wholesaling is a short-term business technique to achieve significant profit. Unlike retail wholesaling, this does not involve selling several properties at reduced prices.

For wholesaling real estate, the wholesaler negotiates a contract with a seller for a (typically distressed) home, shops it around to potential buyers, and then assigns the contract to one of them.

Rather than buying and selling a home, the wholesaler contracts it with the seller and seeks a buyer. The purpose of real estate wholesaling is to sell the home to a buyer before the original homeowner's contract expires.

This means that no money is exchanged between the wholesaler and the supplier, at least not until the wholesaler finds a buyer.

So to wholesale real estate, you find a buyer ready to pay more for the house than the seller agreed to. And the difference in price paid by the buyer is your profit.

What You Need to Wholesale Real Estate

To get into wholesaling real estate, you need to understand its requirements first. Beginner real estate wholesalers should consider the following before diving into the business.

Networking

Networking is perhaps the most essential tool to have if you want to wholesale real estate. Your goal here is to build relationships with industry professionals, lawyers, title firms, lenders, and movers.

Other than providing information on properties for sale, they can also guide you in the direction of buyers, who are equally important in the process of making contacts.

Funds

While you don't need money to wholesale real estate, you must be able to move the contract before payment is due. Even if you have an extensive network, this is a risky tactic, warranting some caution.

The amount of money you can invest in wholesaling real estate is always a significant issue, but the good news is that the process involves very little, if any, of your own money. However, there may be fees outside of the property that you must consider.

Negotiation

Unless you can persuade the seller to reimburse these expenses, you will be responsible for earnest money, appraisal, and title company fees. That is where negotiation comes in. Your role in the process is to help with the transaction and find a buyer.

Remind the seller that your objective is to work out a deal to help them find a buyer more quickly. The seller's profits will be reduced due to this process, but they will save the trouble of marketing and negotiations themselves.

Marketing

Besides having sufficient market knowledge, it's crucial for real estate wholesalers to have a sound marketing plan.

From targeting mailing lists with ads to putting up signs or simply driving around to spot potential properties, any activity that can land you leads and brand exposure are required marketing activities for wholesalers.

PRO TIP: Check out our real estate investing resource list for help with marketing and finding prospects.

License

You don't need a permit to wholesale real estate. While a license gives you an advantage, it is not an absolute necessity.

But having a license can grant you access to the MLS, which displays listings before they are made public. That's a valuable tool to have if you're looking for properties priced below market value.

Pros and Cons of Real Estate Wholesaling

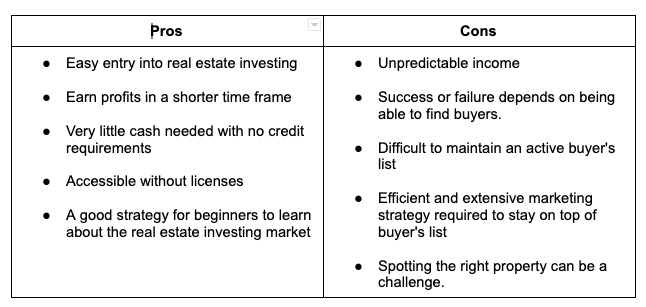

While wholesaling real estate provides one of the most accessible entries into the world of real estate investing, you need to weigh the pros and cons first.

How Does Real Estate Wholesaling Work?

The entire process of wholesaling real estate is dependent on the research and connections you make. Following that, it's just a matter of making and completing the contract. To chart out all the stages in the process, here's a rundown of the steps you'll need to wholesale real estate:

Researching

The first stage in any wholesale transaction is to conduct research and formulate strategies. It's critical to educate yourself on the complete process. Attending a real estate event in your region is a terrific place to start.

Make connections with other investors and meet people in your area who have wholesale experience. This will give you a better understanding of the process and may lead to a beneficial industry link down the road.

You'll be better equipped to perform local market research and develop a business plan once you know what to expect.

Building a Buyer's List

A buyer's list is a group of people who might be interested in investing, starting a business, or buying a home. A good buyer's list will ensure that you always know where to look for bargains.

Buyers can be located in various areas, from direct mail to bandit signs, but personal relationships are the most acceptable methods to create a list.

Finding the Property

On paper, finding a property seems simple, but you shouldn't jump headfirst into the first lead that comes up. When creating a buyer list, it's essential to know what criteria they're looking for in a home.

Once you know what your buyers want, you can better target properties that will appeal to them while also being below market value to increase your profits.

Building a Backup Plan

It's usually a good idea to have a backup plan for real estate investing. While wholesale real estate investments are considered low-risk, there is always the possibility that something will go wrong.

In that scenario, you must ensure the financial resources and the will to see the deal through. Whether you intend to rehab the home and resell it or rent it, having a backup plan is always a good idea.

Negotiation and Signing

When you've found a motivated seller, work out the best price and terms for their property. Approach potential sellers to negotiate a contract and emphasize how to make the selling process easier for them.

Focusing on the aspects of the deal you are taking over is an excellent strategy for easing the load of property ownership. As you finalize the talks, make sure you're on the same page and include all relevant information in the agreement.

Knowing all of the legal processes involved in a real estate purchase is always a plus. You can also consult with a lawyer to ensure that all of the bases are covered.

Marketing to Motivated Sellers

A motivated seller is a homeowner eager to sell their home for various reasons: past due mortgage payments, newly inherited properties, or relocation. These sellers are your greatest bet for getting a property under contract for a reasonable price.

Targeting lists of delinquent taxpayers, absentee owners, and homeowners in pre-foreclosure, for example, is a practical approach to finding such sellers.

After you've created a target list of motivated sellers, design a marketing campaign crafted to attract them. Select an approach that best reaches your target audience. Despite digital leads being more convenient and widespread, traditional methods like direct mail are also proven effective marketing techniques for motivated sellers.

Connecting with Buyers

As soon as you sign a contract on a property, your actual work begins. Your ultimate goal will be to sell that contract to a willing buyer. If all goes according to plan, you should be able to find someone from your buyer's list. Make a list of comparable properties and calculate possible repair costs to present in the title report to your buyers.

Then start contacting as many potential purchasers as possible. But keep in mind that different properties will appeal to different types of buyers.

For example, distressed properties may appeal to rehabbers, whereas homes needing a few minor repairs may appeal to a rental property investor.

Assigning the Contract

Create an assignment of the contract agreement once you've found an end buyer. Make sure you agree on your assignment fee and deposit amount and include them in the final contract.

The amount of money you're assigning to the contract should also be stated in the final agreement. That way, you will ensure that all parties are on the same page.

Closing and Collecting

On the day of the finish, make sure the buyer is present to sign the necessary documents. Ensure they bring all the required paperwork and payment to purchase the property, including your assignment fee.

The title firm will cut you a check for your fee amount after they accept the price. Finally, for your future wholesale deals, consider requesting a testimonial for your portfolio.

Real Estate Wholesaling Methods

There are two fundamental procedures for closing a contract in wholesale real estate: assigning the contract and double escrow (also known as double close):

Assigning the Contract

The most straightforward approach to wholesale real estate is to set a contract. Giving a contract means that the wholesaler sells the contract rather than the property itself. Once they assign the contract for a subject property, the end buyer essentially becomes the buyer.

Remember that you'll need to enter a purchase and sell agreement to buy a subject property in wholesale trade. Also, check to see if the warranty prevents you from transferring or selling the contract to a third party.

By default, all warranties can be sold to a third party (unless the agreement states otherwise). It's critical to note that assigning a contract does not imply that you're selling the property or that your name will appear on the title.

You are merely giving your rights to acquire the home under the contract and selling those rights to the eventual buyer for a profit. You get your finder’s fee for serving as the middleman once the transaction is completed.

The Double Close

A wholesaler may undertake a double escrow in certain circumstances, such as when the seller refuses to consent to an assignment of the contract provision or when local restrictions prohibit it.

A "simultaneous close," often known as a "double closing," is a lucrative real estate wholesaling practice.

In essence, a double closing involves an investor purchasing a property and then reselling it later. During a double closure, you establish a chain of title and, as a result, are regarded as the legal owner of the property for a limited time.

As a result, property ownership is officially transferred from the seller to you. It's then up to you to locate a buyer willing to pay more for the property than you paid for it.

While the execution of a double closing is similar to that of a standard purchase, wholesalers should check with their lender to see if this sort of transaction is permitted.

Real Estate Wholesaling vs. Flipping

In many ways, real estate wholesaling is akin to flipping. Both use the property as a means of making money and investing. In some form or another, both necessitate contracting and selling a residence. There are, nevertheless, significant differences between the two.

House flipping is usually intended for investors that have a little more money, time, and experience. The procedure is more expensive, takes longer, and carries more risk.

At the same time, flipping can pay off handsomely for well-prepared investors. On the other side, wholesaling real estate is more closely associated with entry-level techniques with a lower profit margin.

Because you don't buy the house or fund the repairs, wholesaling carries a more negligible risk. Instead, a wholesaler spends their time and money generating leads and marketing to sellers, which costs a lot less than buying and rehabbing the home.

All in all, real estate wholesaling takes a lot less time to complete, costs less money upfront, and lowers risk exposure.